Brexit, is simply that the United Kingdom (UK) is leaving the European Union (EU).

The UK has been a member of the European Union for almost 50 years and the process of leaving is not easy. Over the decades the regulatory framework, trading practice, cross-border policing, energy supply and national security are but a few critical areas where the UK and it fellow members states have acted in unison. Unpicking this is relationship is no easy business.

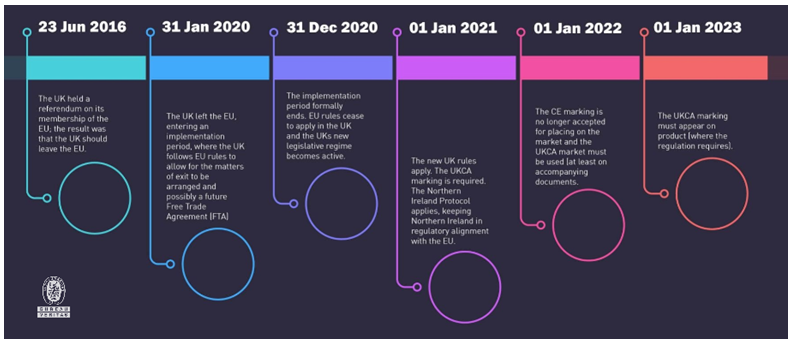

The UK officially left the EU on 31st January 2020. In order to find time to work on a Free Trading Agreement (FTA) to mitigate the impact of the changes, the UK is in an “implementation period”, where it has agreed to follow EU rules. This implementation ends on 31 December 2020.

Unless a FTA is agreed, goods and services will be subject to different rules in the EU and UK for the first time in decades.

Free Trade Agreement (FTA)

The UK and the EU are attempting to negotiate a wide-raging Free Trade Agreement (FTA). The FTA being discussed is one of the most broad ranging in history, covering everything from Citizens rights, Security, Energy Use, Goods and Services Legislation and taxes and tariffs.

There is deliberately little detail in this page since, as of writing, there is no conclusion of any FTA between the UK and EU. Several self-imposed deadlines have come and passed and the sides appear to remain deadlocked.

It is worth noting that much of the advice on product legislation is unlikely to change, even if there is an agreement before the end of 2020.

The Withdrawal Agreement

The Withdrawal Agreement concluded between the European Union and the United Kingdom establishes the terms of the United Kingdom's orderly withdrawal from the EU. The Withdrawal Agreement entered into force on 1 February 2020. It includes a protocol on Ireland and Northern Ireland which explains how the two markets will operate following the UKs exit from the EU.

It covers many important details of the withdrawal, including, the geographical scope, citizens’ rights, and goods regulation.

Importantly for goods, it states that:

Any good that was lawfully placed on the market in the Union or the United Kingdom before the end of the transition period may be further made available on the market …and circulate between these two markets until it reaches its end-user.

Meaning goods already placed on the market can continue to circulate indefinitely, or until the regulations prevent this.

How Will Brexit Affect Me?

Brexit will affect anyone that sells goods to, or manufacturers’ goods in, the UK or the EU. There are many changes but we have listed a few of the most significant ones:

Products

• Legislation governing products will be changing.

• Business with addresses in Great Britain will be considered as businesses in a third country from the point of view of the EU. This means that goods supplied into the EU from GB will need to name an EU economic operator in many cases.

• The same is true in reverse: goods supplied into GB from the EU will need to name a GB economic operator in many cases.

• Different conformity marks and separate conformity assessment processes may be required.

• Declarations of conformity will need to be update and it is likely the will need to be one declaration for GB and one for the EU

Regulations

• Generally speaking, regulations in the UK and EU will be aligned and will likely stay this way in the short term. However the EU is a fast moving regulatory environment and the UK will likely be out of step with the EU or possibly diverge from the EU over the course of the next year or two.

• The EU regulations have a harmonising effect across the EU. Business in the UK may find itself subject to national regulations in individual member states.

Customs

• For the first time in decades, when the UK leaves the EU, there will be a border in operation between the UK and the EU. Current when goods enter the EU are subject to the EU Common Extern Tariff, used in every member state, regardless of port on entry. After the UK leaves, products entering the EU will still be subject to the EU external Tariff but products entering the UK will be subject to the new UK Global Tariff.

• Importantly, subject to a Free Trade Agreements under discussion, the customs tariffs will apply to goods shipped from UK to the EU and vice-versa. Businesses who regularly ship goods between the two markets could be subject to significant extra duties.

VAT

• Similar to the issue with customs tariffs, VAT will need to be paid on import. After exit VAT will need to be paid at import, separately, in both the EU and the UK. The UK have made allowance for VAT payments to be deferred.

• After Brexit, exports from both markets to the other can be zero rated, just as exports to markets outside the EU are zero rated before exit.

Border Operations

• The need for customs checks and the new tariffs and taxes mentioned above, lead to a new set of operations at the physical border. The UK have published detailed guidance.

• Exporters, their customs agents and their logistics operators will need to be aware of the new model. Not having the correct paperwork may mean shipments are rejected.

Northern Ireland

• Northern Ireland will have a special status in law. The rules in operation will remain aligned with the EU yet the country will still remain part of the UK. Businesses in Northern Ireland will need to carefully check rules that specially apply.

Data

• Following the UKs Exit from the EU, the General Data Protection Regulation (GDPR) will apply in each market. The EU will retain the GDPR and the UK will establish a new identical version.

• Companies in the UK sending Personally Identifiable Information to the EU will need to assess if they need to set up data protection standardised contractual clauses or even set up a representative in the EU for data handling.

• The same works in reverse, companies based in the EU will need to consider how they ensure protection of data in the UK

Download Brexit Update

DOWNLOAD